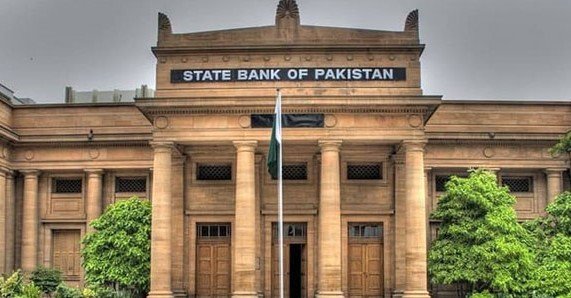

The State Bank of Pakistan (SBP) has issued a regulatory framework, namely “Business Conduct and Fair Treatment of Consumers Regulatory Framework (BC&FRF)”.

It issued the framework in alignment with its Vision 2028 and strategic objective of strengthening market conduct and consumer protection.

This pioneering framework sets a new benchmark for industry standards. And it paves the way for a more inclusive, trustworthy, and resilient financial ecosystem that benefits all stakeholders.

The SBP has finalised the framework after an extensive consultation with stakeholders from both the financial institutions and consumers. It establishes both principles-based and rule-based obligations applicable to banks, Development Finance Institutions (DFIs), Electronic Money Institutions (EMIs), and Payment System Operators/Payment Service Providers (PSOs/PSPs). The framework addresses the complete product lifecycle, ranging from product development and pre-sale disclosures to service delivery, complaints handling, and termination of relationship processes. It developed with a view to fostering a customer-centric financial services ecosystem.

Framework:

The framework is structured around two main parts: Part I contains obligations in the form of outcome-based general principles, while Part II comprises six key pillars. These pillars include: (i) Governance and Oversight – focused on institutional responsibilities and the role of leadership in fostering a culture of fair conduct; (ii) Disclosure and Transparency – aimed at ensuring timely, accurate, and accessible information enabling consumer to make informed decision-making; (iii) Fair Treatment and Business Conduct – to promote equitable, inclusive, and non-discriminatory practices; (iv) Data Protection and Privacy – prescribing standards for safeguarding consumer data; (v) Dispute Resolution Mechanism – ensuring the availability of fair, efficient, and accessible redress mechanisms; and (vi) Awareness and Capacity Building – which underscores the dual importance of institutional readiness and consumer education.

The issuance of the framework marks a transformative step in enhancing business conduct and ensuring the fair treatment of consumers within Pakistan’s financial sector. By embedding principles of fairness, transparency, and accountability, the State Bank of Pakistan reaffirms its unwavering commitment to protecting consumer rights and promoting ethical business conduct.