Pakistan’s liquid foreign reserves stood at $19,680.9 million as of September 05, 2025.

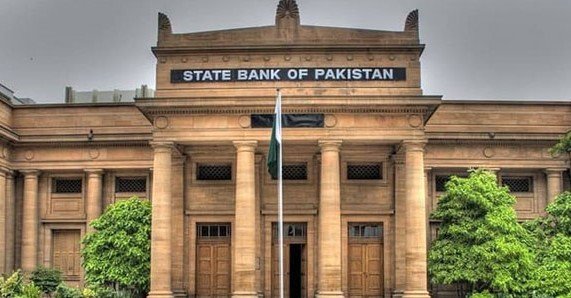

As per the data shared by the State Bank of Pakistan (SBP) on Thursday afternoon, the central bank’s foreign reserves stood at $14,336.3 million. Net foreign reserves held by the commercial banks stood at $5,344.6 million.

During the week ending September 05, 2025, SBP’s foreign reserves increased by $34 million to $ 14,336.3 million. Last week, SBP’s reserves increased by $28 million to $14,302.5 million. Two weeks back, SBP’s foreign reserves increased by $18 million to $14,274.3 million.

Before that week, the central bank’s foreign reserves increased by $13 million to $14,256.2 million. Four weeks back, the central bank’s foreign reserves increased by $11 million to $14,243.2 million.

Five weeks back, SBP’s foreign reserves dropped by $72 million to $14,231.9 million due to external debt repayments. Six weeks back, SBP’s reserves decreased by $153 million to $ 14,303.9 million.

During the week ending July 18, 2025, the central bank’s reserves dropped by $69 million to $14,456.6 million due to external debt repayments. Before that week, SBP’s reserves increased by $23 million to $14,525.6 million.

Reports say that reserves fell to a critically low level, $4.4 billion, when inflation peaked at 38% in May 2023. It caused serious macroeconomic instability in Pakistan. But, decisive monetary tightening and structural reforms gradually improved the situation. Improved external inflows also played a key role in shifting the trajectory towards stability.”

Meanwhile, on August 29, Pakistan’s liquid foreign reserves stood at $19,659.5 million. The central bank’s liquid foreign reserves stood at $14,302.5 million. Commercial banks’ net foreign reserves stood at $5,357 million as of August 29, 2025. The SBP stated this at the end of last month.

The State Bank of Pakistan (SBP) yesterday unveiled the Mid-Year Performance Review of the Banking Sector. It covers the performance and soundness of the banking sector for the period from January to June 2025. The report briefly discusses the performance of financial markets as well as the results of the Systemic Risk Survey (SRS), which represents the views of independent experts about key current and potential future risks to financial stability.

Read more: